How to Navigate Italy’s Tax Breaks and Fiscal Consolidation

Given the difficulties posed by high interest costs, excessive past incentives, and delays in spending on the recovery plan, the government of Italy needs to come up with a credible plan for medium-term fiscal consolidation in order to stabilize the public debt.

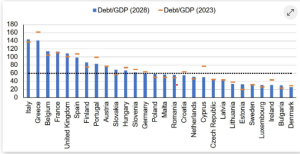

In the next three years, Italy’s public debt, which is rated BBB+ and Stable Outlook by Scope Ratings

Super bonus: The estimated EUR 135 billion in required fiscal consolidation is slightly higher than the cost of tax incentives granted for building renovations aimed at improving their energy efficiency, known as the Super bonus, which has resulted in EUR 122.2 billion in tax credits. However, the negative effects on debt levels are growing. The Italy’s RRP continues to face spending delays and implementation challenges.

In the event that the European Commission does not extend the deadline for 2026, the majority of investment—

More related post here